A Positive Step Forward

March 1, 2017

(This article first appeared in the March-April 2017 issue of The American Postal Worker magazine.)

On Jan. 31, the Postal Service Reform Act of 2017 (H.R. 756) was introduced by Representatives Jason Chaffetz (R-UT), Elijah Cummings (D-MD), Mark Meadows (R-NC), Gerry Connolly (D-VA), Dennis Ross (R-FL) and Stephen Lynch (D-MA).

“This legislation is a necessary step to solving the disastrous pre-funding mandate that is dragging down the Postal Service,” said President Dimondstein. “We are encouraged by the bipartisan effort to fix the financial problems currently facing the USPS while preserving good union jobs and public postal services.”

There are many components of the new postal reform legislation, including the restoration of half of the postal rate increase and removal of a provision lobbied by the USPS’s private competitors. The portion of the bill that concerns many APWU members is the Medicare integration for postal retirees.

‘Medicare Integration’

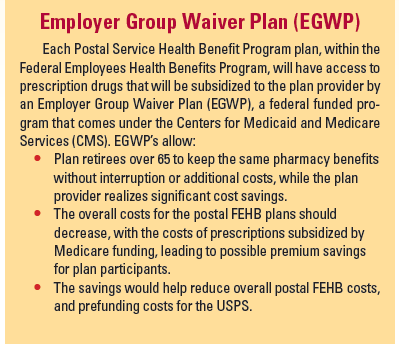

H.R. 756 addresses the pre-funding mandate through “Medicare integration.” A “Postal Service Health Benefit Program” will be created within the Federal Employee Health Benefits Program (FEHBP), managed by the Office of Personnel Management (OPM). It would place Medicare-eligible postal workers in Medicare Parts A and B. In addition to expanding Medicare’s role as a primary payer, FEHBP plans would be given access, through the law that created Medicare Part D, to discounted prescription drugs subsidized by an Employer Group Waiver Plan (see box below for more information).

At this time, approximately 80 percent of Medicare-eligible postal workers and retirees are voluntarily enrolled into Medicare A and B. Many APWU members say that having a FEHBP plan and Medicare saves them money in the long run.

The bill achieves the following goals of the union:

- The program remains part of the FEHBP;

- The Medicare integration is part of the comprehensive reform bill, not a stand-alone measure;

- Prescription drug coverage results in no additional costs to employees and retirees;

- The Postal Accountability and Enhancement Act’s (PAEA) required payments to pre-fund future postal retiree health care will be virtually eliminated by Medicare integration because it will create a huge reduction in the current unfunded liability costs.

Whether or not they enrolled, postal employees have long subsidized Medicare, paying over $30 billion in Medicare taxes since 1983. Postal employees, retirees and the Postal Service can realize the benefit of those contributions through Medicare integration. The APWU believes, although not perfect, this bill provides a workable route to achieve a robust future for America’s Postal Service.

Whether or not they enrolled, postal employees have long subsidized Medicare, paying over $30 billion in Medicare taxes since 1983. Postal employees, retirees and the Postal Service can realize the benefit of those contributions through Medicare integration. The APWU believes, although not perfect, this bill provides a workable route to achieve a robust future for America’s Postal Service.

H.R. 756 is expected to finish being “marked up in committee,” where the bill can be amended and advanced to the full House of Representatives, by the beginning of March. As the legislation continues work its way through Congress, the APWU will stay engaged in the process with lawmakers and staff to improve the bill every step of the way.

Stay informed about the progress of H.R. 756! Sign up for legislative updates (http://bit.ly/2jmznE3) and check the Legislative & Political Department’s webpage regularly.